Slack

Push payroll alerts into channel-based workflows and thread through approvals in minutes.

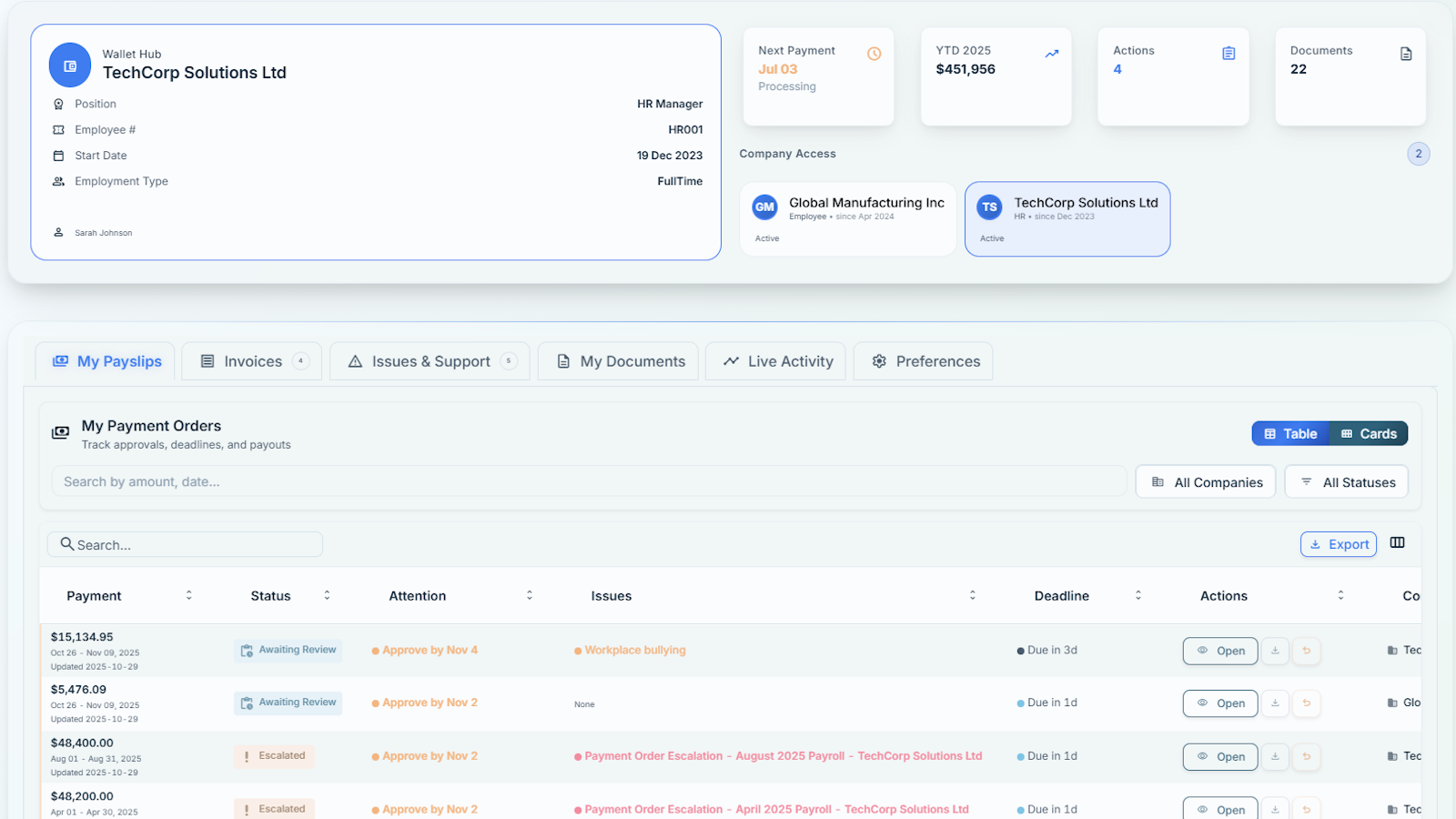

Employee and vendor self-service removes payroll guesswork, keeps every step visible, and captures their sign-offs before finance releases payments.

Trusted by enterprises managing 180,000+ employees

AI copilots every payroll review so finance sees issues before accrual, while every worker can self-serve corrections.

Employees confirm, correct, or dispute payslips with AI guidance, creating documented sign-offs without slowing payroll.

Unify workforce invoices, vendor onboarding, and payment status in one trail—no more ad hoc spreadsheets or missing receipts.

Immutable audit trails and anomaly scoring surface risk hotspots while keeping auditors and leaders aligned in real time.

Native connectors for the tools payroll, HR, and operations rely on daily. Automate escalations, surface approvals, and push status updates without rebuilding your stack.

Push payroll alerts into channel-based workflows and thread through approvals in minutes.

Deliver variance notifications and payroll checklists to the groups already coordinating execution.

Convert anomalies into trackable issues, rolling status back into Stribely automatically.

Mirror employee tasks, SLAs, and payroll close milestones without another status doc.

Sync master data, pay codes, and approvals while preserving your system of record.

Extend the platform with event-driven payloads and custom data syncs for any stack.

We invite the people closest to the work to approve and correct details, while finance and compliance stay in control of every policy gate, audit step, and vendor payment. Documented acknowledgements create shared accountability before any payroll or vendor file is released.

Finance teams across regulated industries trust Stribely to keep every tenant, employee, and vendor aligned. See the platform in action.

Let’s align on your payroll operations, understand the approvals you need to automate, and map the integrations that matter.